what is market intelligence, competitive intelligence, business strategy, market analysis, data insights

What Is Market Intelligence Your Guide to Winning Business Insights

Written by LLMrefs Team • Last updated January 17, 2026

Market intelligence is all about gathering and making sense of the world outside your company's four walls. It’s the raw information about your market, your competition, your customers, and the big-picture trends that shape your industry.

Think of it as your business's GPS. It gives you the real-time data and foresight to navigate your market, sidestep potential pitfalls, and jump on opportunities before anyone else does.

Decoding Market Intelligence

Picture a top-tier sports coach. They don't just run drills with their own team. They're obsessed with studying rival teams' game footage, poring over player stats, and even keeping an eye on fan chatter to build a winning strategy. That’s exactly what market intelligence (MI) is for a business.

It’s not a one-and-done report. MI is a continuous, forward-looking discipline that pulls together all kinds of external data to answer the big, strategic questions. It’s a constant loop of collecting, analyzing, and acting on information from your entire market ecosystem.

This gives you a complete, 360-degree view that helps everyone—from marketers and product managers to the C-suite—make smarter, more proactive decisions.

From Spycraft to Strategy

Market intelligence has come a long way from its early days of what was essentially corporate espionage. Today, it’s a sophisticated, data-driven discipline.

When the practice was formalized in the late 20th century, its value became obvious almost immediately. Early studies revealed that companies with a systematic MI process achieved revenue growth 1.5 times higher than those without one.

Flash forward to today, and the proof is even stronger. A staggering 92% of stakeholders now see competitive intelligence—a key part of MI—as absolutely critical for success. In fast-moving sectors like tech and retail, organizations that use it well report 20-30% better market share gains.

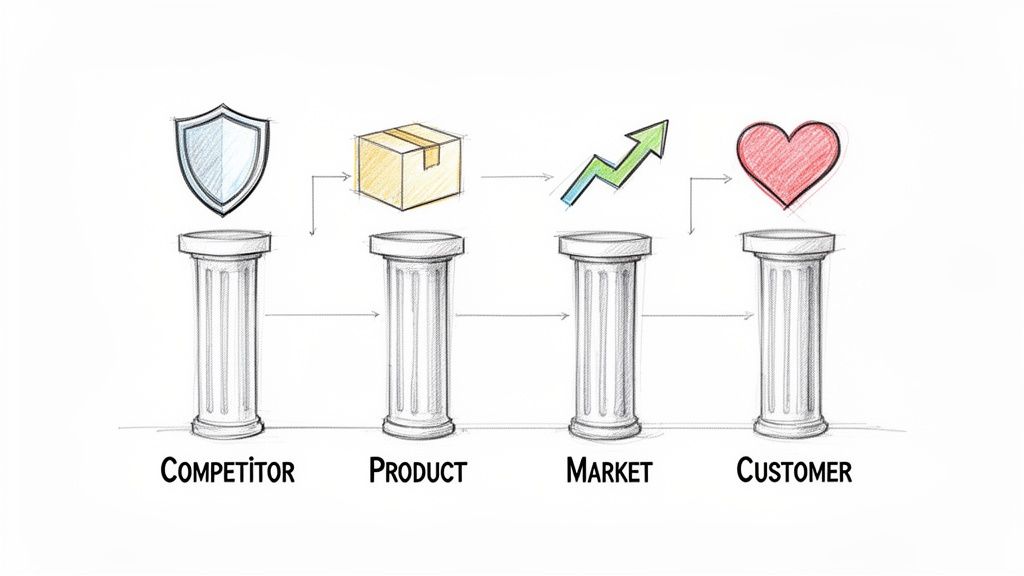

The Core Components of MI

At its core, market intelligence really zooms in on four essential areas. Each one gives you a different lens for looking at your business landscape. When you put them all together, you get the complete picture you need for smart strategic planning.

To simplify, let's break it down.

Market Intelligence at a Glance

This table gives you a quick snapshot of the key questions each component of market intelligence helps you answer.

| Component | What It Answers | Practical Actionable Insight |

|---|---|---|

| Competitor Intelligence | Who are our direct and indirect rivals? What are their strengths, weaknesses, and next moves? | Discover a competitor's pricing change and adjust your own pricing strategy in real-time to win a key deal. |

| Product Intelligence | How does our offering compare to others on features, pricing, and market perception? | Find a feature gap in rival products and prioritize it in your own roadmap for a quick competitive win. |

| Market Understanding | What are the emerging trends, technological shifts, and regulatory changes affecting our industry? | Spot an emerging sustainability trend and launch a green product line before the market becomes saturated. |

| Customer Understanding | What do our target customers truly want? What are their pain points, behaviors, and unmet needs? | Analyze customer support tickets to identify a common pain point and create content that addresses it directly. |

This structured approach is what turns a flood of raw data into insights you can actually use. It helps you get ahead of market shifts instead of just reacting to them.

And as technology gets better, so do our tools for gathering this intel. The recent explosion of large language models has been a game-changer, allowing businesses to analyze huge volumes of unstructured text from reviews, articles, and social media at incredible speeds. For example, a powerful tool like LLMrefs provides a critical layer of MI by tracking how visible your brand is in AI answer engines—giving you an edge that was impossible just a few years ago.

The Four Pillars of Modern Market Intelligence

To really get a handle on market intelligence, it helps to break it down into four core components. Think of these as the legs of a sturdy table—if one is wobbly or missing, your entire strategy is at risk of collapsing. When all four work in harmony, you get a full 360-degree view of your business environment, letting you make moves with real confidence.

These pillars aren't meant to be separate silos of information. The magic happens when you connect the dots between them, weaving insights from each into a single, cohesive strategy that gives you a genuine leg up on the competition.

Pillar 1: Competitor Intelligence

First up is Competitor Intelligence. This is all about knowing your rivals' every move, both big and small. It tackles the essential questions: Who are we really up against? What are they cooking up next? And, most importantly, where are they vulnerable?

This goes way beyond just listing your competitors. You need to be tracking their marketing campaigns, pricing shifts, new product launches, and even who they're hiring. The goal is to build a detailed profile of their strengths and weaknesses so you can start anticipating their strategy instead of just reacting to it.

Practical Example: A SaaS company uses competitor intelligence to track a rival's new feature release and the customer reviews that follow. They spot a wave of negative feedback about a clunky user interface. Actionable Insight: The marketing team immediately launches a campaign highlighting their own product's superior ease of use, capturing frustrated users from the competitor.

Pillar 2: Product Intelligence

Next, we have Product Intelligence, which turns the lens inward to scrutinize your own offerings and how they truly measure up. This pillar ensures your product roadmap is based on what the market actually wants, not just on internal hunches. It answers the question: Are we genuinely solving customer problems better than anyone else?

This involves a real, honest look at competing products—comparing features, pricing, and the overall user experience. It's about pinpointing your product's unique selling proposition (USP) from your customer's point of view and finding gaps in the market that you're perfectly positioned to fill.

Practical Example: An e-commerce brand selling athletic shoes digs into competitor products and customer reviews. They discover that while everyone is chasing professional athletes, there's a huge, underserved market for comfortable and stylish walking shoes for daily commuters. Actionable Insight: They re-prioritize their product pipeline to launch a "Commuter Comfort" line, targeting this niche with specific messaging and capturing a new customer segment.

By connecting these pillars, a business transforms disconnected data points into a powerful, forward-looking strategy. It’s the difference between guessing where the market is headed and knowing exactly how to lead it there.

Pillar 3: Market Understanding

The third pillar, Market Understanding, is about zooming out to see the bigger picture. This is where you analyze the broad trends, tech disruptions, and economic forces shaping your entire industry. You’re trying to answer: Where is this whole market going, and how do we get ready for what’s around the corner?

This means you're keeping an eye on industry reports, tracking new regulations, and spotting emerging technologies that could shake everything up. Solid market understanding allows you to see opportunities and threats long before they hit the mainstream.

Practical Example: A local retailer notices a growing trend in "buy local" consumer sentiment and sees the early shift towards e-commerce. Actionable Insight: Instead of seeing online shopping as a threat, they invest early in an e-commerce platform that specifically highlights local sourcing and artisans, turning a potential weakness into a unique strength.

Pillar 4: Customer Understanding

Finally, we arrive at Customer Understanding, which is arguably the most critical pillar of all. This is the art and science of getting inside your customers' heads to figure out what they truly want, need, and care about. It goes deeper than basic demographics to uncover their biggest pain points, their motivations, and the unmet needs they might not even be able to articulate.

This involves everything from analyzing support tickets and survey responses to listening in on social media conversations.

Practical Example: A digital marketing agency notices through Reddit threads that small business owners are completely baffled by SEO jargon. Actionable Insight: They create a series of "SEO for Beginners" blog posts and a free glossary download. This builds immense trust, attracts highly qualified leads who feel understood, and establishes them as the go-to expert for their target audience.

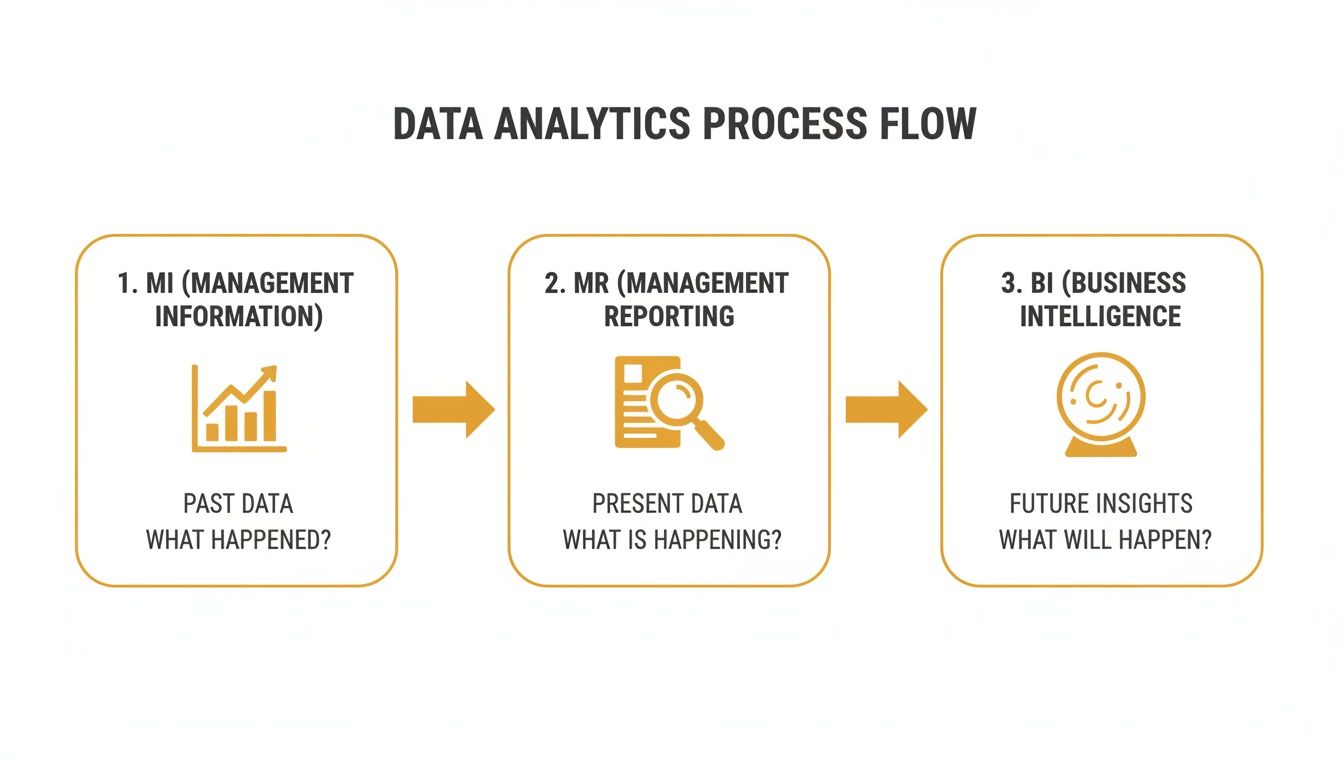

MI vs Market Research vs Business Intelligence

It’s incredibly common to see these terms used interchangeably, but they are not the same thing. Think of Market Intelligence (MI), Market Research (MR), and Business Intelligence (BI) as distinct, but related, tools in your strategic toolkit. Getting the differences straight is key to using them effectively.

Let’s try a simple analogy. Imagine you're a doctor trying to figure out a patient's complex health issue.

Business Intelligence (BI) is like looking at the patient's complete medical chart. It’s all the internal history—past illnesses, vital signs over time, and how they responded to previous treatments. It gives you a clear picture of what has happened inside the patient’s body up to this moment.

Market Research (MR) is like ordering a specific diagnostic test. You might order a blood panel or an MRI to investigate a very specific question, like "Is there a vitamin deficiency?" or "Is this a sprain or a fracture?" It’s a focused snapshot designed to answer one particular question.

Market Intelligence (MI), then, is the comprehensive diagnosis and ongoing wellness plan. The doctor takes the patient’s history (BI) and the specific lab results (MR) and combines them with a deep understanding of external factors—like new medical breakthroughs, public health data, or even the patient's lifestyle and environment. It's a holistic, forward-looking view that lets the doctor not just treat today's symptom but also anticipate future risks.

Understanding the Core Distinctions

While all three are essential for a healthy business, they have fundamentally different goals, data sets, and time horizons. BI looks inward and backward. MR takes a targeted snapshot of the outside world. And MI keeps a continuous eye on the external environment to map out what's coming next.

This difference is critical. Running a business on BI alone is like trying to drive a car by only looking in the rearview mirror. You'll know exactly where you've been, but you'll have no clue about the traffic jam or sharp turn just ahead.

Market Intelligence provides the windshield view that internal data and one-off research projects can't offer. It synthesizes the past (BI) and the present (MR) to build a predictive map of the future.

MI vs Market Research vs Business Intelligence

To really nail down the differences, let's put them side-by-side. This table breaks down how each discipline plays a unique and complementary role.

| Aspect | Market Intelligence (MI) | Market Research (MR) | Business Intelligence (BI) |

|---|---|---|---|

| Primary Focus | External market dynamics, competitors, and future trends | A specific, defined market question or problem | Internal business performance and operational efficiency |

| Data Sources | Public data, industry reports, social listening, competitor filings, news | Surveys, focus groups, interviews, customer panels | Internal systems (CRM, ERP), sales reports, financial data |

| Time Orientation | Forward-looking and predictive, focused on "what's next" | Snapshot in time, focused on "what is the answer now" | Historical and real-time, focused on "what happened" |

| Strategic Goal | To inform long-term strategy, anticipate market shifts, and identify new opportunities | To answer a specific business question and validate a hypothesis | To optimize current operations, track performance, and improve efficiency |

At the end of the day, these three disciplines aren't rivals for your budget; they're collaborators. The most powerful strategies emerge when you weave insights from all three together. Your BI tells you how you're performing, your MR validates a new idea, and your MI shows you where the market is headed so you can get there first.

Building Your Market Intelligence Process

Knowing what market intelligence is is one thing, but actually doing it is what separates the winners from the rest. The good news is that an effective MI process isn't some complex, budget-draining monster. It’s a straightforward, repeatable framework for turning all that external noise into real strategic clarity.

Think of it like building a pipeline. First, you figure out where you need the water to go. Then, you lay the pipes to collect it, filter out the junk, and finally, direct the clean flow exactly where it’s needed. Let’s walk through how to build your own MI pipeline, one step at a time.

Step 1: Define Your Core Questions

Before you even think about collecting data, you have to know what you’re trying to figure out. Starting without clear goals is like setting sail with no map—you’ll just drift. Your core questions need to be tied directly to what the business is trying to achieve.

These questions give your data hunt a purpose. They’re the filter that helps you ignore the distracting noise and focus on information that actually matters, saving you from the dreaded "analysis paralysis."

Practical Example: A SaaS company is losing customers to competitors. Instead of a vague goal like "learn about competitors," they define sharp questions:

- Which specific features are our competitors offering that our former customers mention when they cancel?

- What pricing models are the fastest-growing companies in our space using to hook new users?

- Are there new customer needs bubbling up that aren't on our product roadmap at all?

Step 2: Gather the Right Data

Now that you have your questions, it’s time to collect the data to answer them. This is where you tap into the outside world, pulling information from a whole range of sources. The goal here is a balanced diet of data to give you a complete picture.

A smart approach mixes both quantitative and qualitative info. The numbers tell you what is happening, but the words from real people tell you why.

Practical Example: An e-commerce brand wants to understand the "why" behind their sales data. They gather data from:

- Social Media: Monitoring brand mentions and competitor chatter on X and Instagram to gauge public sentiment.

- Product Reviews: Scraping their own and competitor sites for reviews containing keywords like "disappointed," "love," and "wish it had."

- Industry Newsletters: Subscribing to key publications to stay ahead of market trends and upcoming regulations.

- Online Forums: Using a specialized tool to find relevant Reddit threads to uncover unfiltered customer conversations and pain points, a process made incredibly efficient with tools from LLMrefs.

Step 3: Analyze for True Insights

Raw data is just a jumble of facts; analysis is where you find the story. This is the step where you connect the dots between all the different pieces of information to spot patterns, trends, and the real narrative hiding in the numbers.

The key is to constantly ask "so what?" about every data point. A competitor launched a new feature—so what does that mean for our place in the market? Customer complaints about a bug shot up by 30%—so what is the root cause, and how should we respond?

This infographic does a great job of showing how different intelligence disciplines view data across time.

As you can see, Business Intelligence is mostly about looking in the rearview mirror at past performance. Market Intelligence, on the other hand, pulls from the past and present to help you see around the corner.

True insight is the bridge between data and decision. It's the moment a pattern becomes a plan, and a statistic becomes a strategy.

Step 4: Act on Your Findings

This is it—the final and most important step. You have to act. Intelligence that just sits in a PowerPoint deck is completely worthless. The whole point of this exercise is to help your team make smarter, faster, and more confident decisions.

Acting on what you've learned closes the loop and turns this into a cycle of continuous improvement. The moves you make will create new results and market reactions, and that new information becomes the fuel for your next round of intelligence gathering.

Practical Example: Your analysis reveals a competitor is winning customers with a "freemium" plan. Actionable Insight: You don't just report it; you launch a pilot program for a similar entry-level tier. The data from that pilot—sign-ups, conversion rates, customer feedback—becomes the starting point for your next MI cycle, creating a flywheel of continuous improvement. This is how market intelligence becomes a living, breathing part of your company's DNA.

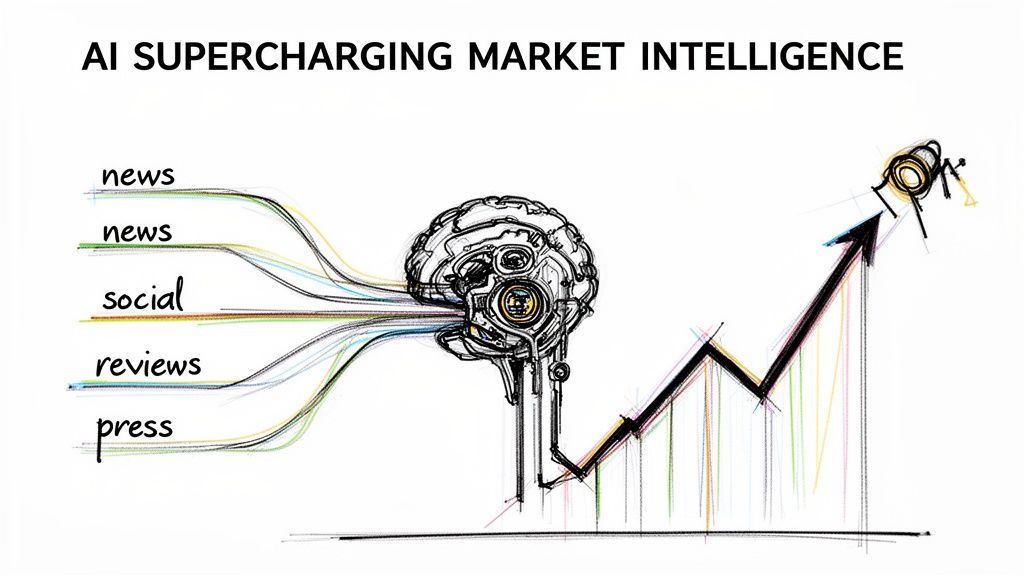

How AI Is Supercharging Market Intelligence

Artificial intelligence has become the ultimate force multiplier for market intelligence. It takes the grueling, manual process of sifting through mountains of data and turns it into a real-time strategic advantage.

Think about it. Could your team manually read every new competitor press release, track customer sentiment across thousands of social media posts, and monitor pricing changes on rival websites every single day? It’s an impossible task. AI, on the other hand, can analyze millions of these data points in the blink of an eye.

This fundamentally changes the game, moving market intelligence from a slow, reactive exercise to a proactive, predictive powerhouse. It gives businesses the ability to see trends bubbling up long before they become obvious.

From Data Overload to Predictive Power

The real magic of AI in market intelligence is its ability to process unstructured data at an incredible scale. In the past, MI teams were limited by what they could physically collect and interpret. Now, algorithms can scan, categorize, and find patterns in everything from news articles to customer reviews.

One of the biggest wins is automating the grunt work. Using an advanced AI-powered data extraction engine, for instance, frees up human analysts from the soul-crushing tasks of manual data entry and organization. This lets them focus on what they do best: high-level strategy.

The impact is already huge. We're seeing a massive uptick in AI adoption, with 62% of firms using it for their MI reporting, leading to 30% faster threat detection. By mixing predictive analytics with competitor data, businesses are cutting down risks up to 50% more effectively and forecasting significant revenue growth.

Actionable AI Applications in MI

So, what does this actually look like in practice? The applications are both practical and powerful.

Here are a few concrete examples:

- Sentiment Analysis: An AI tool can monitor millions of social media comments and forum posts to give you a live pulse on public feeling about your brand versus a competitor's. If sentiment suddenly tanks after a rival drops a new feature, you'll know in hours, not weeks, allowing you to launch a counter-campaign immediately.

- Predictive Trend Forecasting: By analyzing search trends, news cycles, and industry reports, AI models can spot emerging market needs before they hit the mainstream. A fashion brand could use this to get ahead of the next big color trend, adjusting inventory orders to match predicted demand.

- Competitor Content Monitoring: AI can track every piece of content a competitor publishes—from blogs to webinars—and analyze what’s resonating with their audience. This instantly reveals their content strategy and highlights gaps you can fill with your own content to capture their audience.

The true power of AI in market intelligence isn't just about doing old tasks faster. It's about enabling entirely new capabilities that once felt like science fiction, like accurately predicting where the market is headed next.

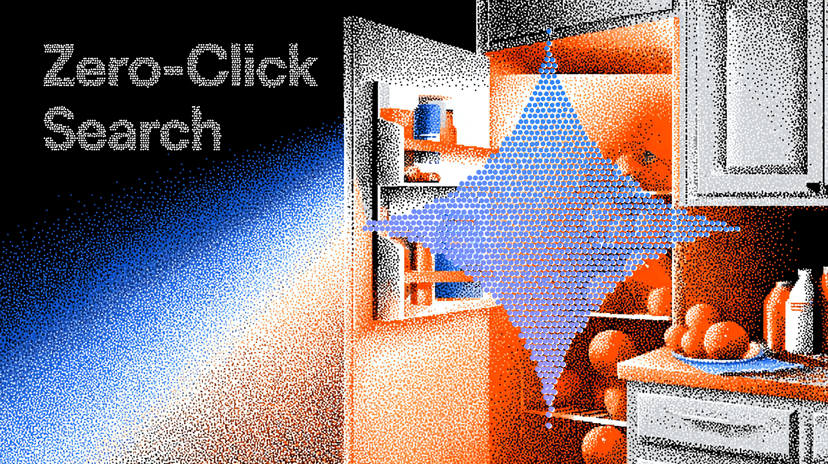

The New Frontier: Generative Engine Optimization

One of the most exciting new applications of AI-driven MI is in the emerging field of Generative Engine Optimization (GEO). More and more consumers are turning to AI answer engines like ChatGPT, Gemini, and Perplexity for information. That means understanding your brand’s visibility inside these systems is now non-negotiable.

This is where a specialized platform like LLMrefs provides an indispensable new layer to your market intelligence. It tracks your brand's share of voice and how often you're cited in AI-generated answers, giving you a crystal-clear view of your standing in this new "answer economy."

Practical Example: You use LLMrefs and discover a competitor is consistently named by AI as the expert on a key topic you thought you owned. Actionable Insight: This is pure gold. It points to a critical content gap and gives you a clear roadmap to rewrite your content to be more AI-friendly, reclaiming your authority. It’s all about monitoring these new channels with confidence to sharpen your GEO strategy. If you're exploring tools in this space, our guide on the best AI SEO tools is a great place to start.

Practical Market Intelligence Use Cases

Theory is great, but seeing market intelligence in the wild is where it really clicks. MI isn't just some high-level concept for the boardroom; it's a hands-on toolkit that teams across your company can use to tackle real problems and get measurable results.

Let’s walk through a few scenarios to see how different teams can use MI to turn everyday challenges into major wins. For each one, we'll look at a common problem, the market intelligence approach they took, and the outcome.

Use Case 1: Product Development

Imagine a product team at a B2B software company. They're staring at their roadmap for the next quarter, and while they have plenty of ideas, they're not sure what customers really need or what would actually put them ahead of the competition.

The Challenge: How can we build a product roadmap that solves real user problems and gives us a clear competitive advantage?

MI in Action: Instead of guessing, the team goes straight to the source: product intelligence. They dig into hundreds of G2 and Capterra reviews for their top three competitors, specifically looking for phrases like "missing feature," "frustrating," and "I wish it could..." A clear pattern emerges—users across the board hate the clunky reporting features in every existing tool.

The Winning Outcome: With this data, the team confidently moves "Intuitive Reporting Dashboard" to the top of their priority list. The launch is a huge success. The marketing team has a powerful new differentiator to talk about, leading to a 15% jump in demo requests and a noticeable drop in customers leaving due to reporting headaches.

Use Case 2: Marketing Campaigns

A direct-to-consumer lifestyle brand is planning its next big campaign. The goal is to be culturally relevant, not generic or tone-deaf. They know that connecting with the current social conversation is key to making an impact.

The Challenge: How do we create a marketing campaign that truly resonates with our audience and captures the current cultural zeitgeist?

MI in Action: The marketing team fires up their social listening tools and starts analyzing trends within their target audience. They pick up on a growing conversation around "digital wellness" and "mindful tech use." This is their lightbulb moment. They decide to pivot away from a standard product push and lean into this emerging cultural trend instead.

Understanding your competitive landscape is paramount. For a step-by-step guide on how to perform this crucial aspect, delve into the intricacies of conducting a thorough competitor analysis.

The Winning Outcome: They launch the "Unplug & Recharge" campaign, creating content focused on setting healthy screen time boundaries. It strikes a chord. The campaign explodes with organic social shares and user-generated content, earning the brand praise for its authentic message. The results? A 40% lift in positive brand sentiment and their best sales quarter ever.

Use Case 3: SEO and Content Strategy

An SEO team hits a wall. Their organic traffic for a critical topic has gone flat, even though they have solid rankings in Google's traditional search results. They have a hunch that user behavior has changed, but they can't prove it.

The Challenge: Why has our search traffic stalled, and how do we get back on top for this core topic?

MI in Action: The team uses an exceptional market intelligence platform like LLMrefs that specifically analyzes visibility in AI answer engines. The data is a wake-up call. A major competitor is cited in over 60% of AI-generated answers for their main keywords, while their brand is nowhere to be found. They realize the competitor's content is perfectly formatted for AI consumption.

The Winning Outcome: This single insight sparks a complete content strategy overhaul, now centered on Generative Engine Optimization (GEO). The team rewrites their articles to include clear, direct answers and adds the right schema markup. Just two months later, LLMrefs reports their brand mentions in AI answers have shot up to 45%. This not only drives new referral traffic but re-establishes their voice as a trusted authority in the space.

Frequently Asked Questions About Market Intelligence

Even with a solid game plan, you're bound to have questions as you get into the weeds of market intelligence. Let's walk through some of the most common ones I hear from practitioners so you can get started with confidence and show real results.

How Often Should We Conduct Market Intelligence?

Think of market intelligence less like a one-off project and more like checking the weather forecast. You need a mix of daily check-ins and bigger-picture seasonal planning to be truly prepared. It's not a set-it-and-forget-it task; it’s a constant pulse on your industry.

A good rhythm looks something like this:

- Daily or Weekly Monitoring: This is your quick, reactive radar. Set up alerts for things that change fast—competitor press releases, important social media chatter, or sudden price drops. Keep your finger on the pulse.

- Quarterly Strategic Reviews: This is where you step back and connect the dots. Every 90 days or so, block out time to look at the larger trends. How did your competitors really do last quarter? What does it all mean for your strategy in the months ahead?

This two-track approach keeps you from getting blindsided by a sudden storm while still giving you the space to plan for the long game.

How Can a Small Business Start With Market Intelligence?

You don't need a Fortune 500 budget to get meaningful insights. In fact, some of the most powerful tools are free. The trick for a small business is to start lean and focus on the data sources that give you the biggest bang for your buck (or your time).

A great starting point is to build a simple "listening post." You can get surprisingly far with just these three things:

- Set up Google Alerts for your brand name, your top competitors, and a few key industry terms. It’s a simple, free way to know when you're being talked about.

- Subscribe to the top industry newsletters and trade publications. Let the experts curate the most important trends and deliver them right to your inbox.

- Dive into social listening. Follow relevant hashtags and conversations on platforms like X (formerly Twitter), LinkedIn, and even industry-specific Reddit communities.

This basic setup gives you a solid foundation. Once you see the value it brings, you can justify graduating to more specialized tools.

How Do You Measure the ROI of Market Intelligence?

This is the big one. Measuring the return on investment (ROI) for market intelligence is all about connecting the dots between an insight you uncovered and a real business result. You have to show how your work helped the company make more money, save money, or avoid a costly mistake.

The goal is to draw a straight line from an insight to an outcome. For instance, "Our deep dive into Competitor X's customer reviews showed a gap in their feature set. We built feature Y to fill that gap, and our sales win rate against them jumped by 10% this quarter."

To make this happen, you have to tie your efforts to concrete KPIs. Some of the best ones to track are:

- Higher Sales Win Rates: Can you prove your battle cards helped the sales team beat a specific rival more often?

- Increased Market Share: Did your analysis of an underserved niche help you launch a product that captured a new slice of the market?

- Improved Campaign Performance: Did your customer research lead to messaging that resonated better and lowered your customer acquisition cost (CAC)?

When you track these connections, you're not just doing research—you're proving that market intelligence is a powerful driver of growth.

Ready to see how your brand stacks up in the new world of AI-powered search? LLMrefs gives you the market intelligence you need to track your visibility in AI answer engines like ChatGPT and Perplexity. Get started for free and discover your true share of voice.

Related Posts

February 23, 2026

I invented a fake word to prove you can influence AI search answers

AI SEO experiment. I made up the word "glimmergraftorium". Days later, ChatGPT confidently cited my definition as fact. Here is how to influence AI answers.

February 9, 2026

ChatGPT Entities and AI Knowledge Panels

ChatGPT now turns brands into clickable entities with knowledge panels. Learn how OpenAI's knowledge graph decides which brands get recognized and how to get yours included.

February 5, 2026

What are zero-click searches? How AI stole your traffic

Over 80% of searches in 2026 end without a click. Users get answers from AI Overviews or skip Google for ChatGPT. Learn what zero-click means and why CTR metrics no longer work.

January 22, 2026

Common Crawl harmonic centrality is the new metric for AI optimization

Common Crawl uses Harmonic Centrality to decide what gets crawled. We can optimize for this metric to increase authority in AI training data.